Most ETFs that invest in stocks that pay dividends distribute those dividends to investors on a schedule, similar to any of the best dividend stocks on MarketBeat. If the ETF invests in bonds that accumulate interest, the ETF will also usually offer a portion of the interest back to investors through dividends. However, not every ETF is required to offer investors dividend distributions, and some companies may elect to reinvest stock dividends earned back into growth operations or research and development.

Before you invest in dividend ETFs, know how to research the sustainability of these payments and be sure that the fund you're investing in is a dividend-paying ETF. Read on to learn more about these assets and how you can learn more about the best dividend stocks and ETFs.

What Are ETFs?

An ETF is an investment vehicle made up of multiple stocks, bonds or other assets traded on the public markets. Unlike mutual funds, you can buy and sell ETFs throughout the day, similar to a single share of stock. This makes them a convenient and affordable option for retail investors.

As ETFs include individual stocks, most have at least a few assets that issue dividends at least once a month. Where the ETF dividends go and how they split up depends on the company managing the fund. While most ETFs distribute at least a portion of their returns to fund holders in the form of dividend payments, some may choose to reinvest the dividends into the fund's assets or other management projects.

If you're looking to invest in an ETF and want to be sure that it distributes a dividend to shareholders, be sure to check the fund's dividend yield before you place a buy order. You can browse some of the best dividend ETFs or start your search by exploring today's top high-yield dividend stocks on MarketBeat.

Types of Dividends

Exchange-traded funds (ETFs) can pay out multiple types of dividends depending on the underlying securities in the ETF's portfolio. The two most common types of distributions are qualified and nonqualified dividends. The difference and the type of ETF dividend you receive will depend on the underlying assets held by the fund and other financial factors.

Qualified and nonqualified dividends are taxed at different rates, so understand the differences before choosing which annual or monthly dividend stocks and ETFs to invest in.

Qualified Dividends

Qualified dividends are a type of dividend subject to a lower tax rate than ordinary dividends. If your dividends are qualified, you will pay the capital gains tax rate on your dividend income rather than the standard income tax rate. For most people, this will result in a much more advantageous tax situation when compared to collecting unqualified dividends.

To be considered qualified, dividends must meet certain requirements set by the Internal Revenue Service (IRS), which include:

- A U.S. corporation or a qualified foreign corporation must issue the dividends.

- The stock on which the dividends are paid must be held for a certain period, known as the holding period requirement.

- The dividends cannot be listed as "unqualified dividends" or "ordinary dividends" on the company's financial statements.

If they meet these requirements, the dividends are considered qualified and are taxed at the long-term capital gains tax rate. The exact tax rate depends on the individual's tax bracket, but as of 2023, qualified dividends are taxed at rates ranging from 0% to 20%.

Unqualified Dividends

Unqualified dividends (also known as ordinary dividends) do not meet the requirements set by the IRS to be considered qualified dividends. An ETF dividend might be classified as unqualified because it was issued by a company based outside of the U.S., the asset has not met the holding period, or it was not approved for capital gains qualification by the IRS for financial reasons. Some select types of companies (like REITs) must pay out unqualified dividends even if they meet the standards for qualified distributions.

Unqualified dividends are subject to the ordinary income tax rate, generally higher than the tax rate for qualified dividends. Depending on your income, you may pay between 10% and 37% of your unqualified dividend income when you file your federal income tax return.

How Dividends Are Allocated

Companies allocate dividends to their shareholders by their dividend policy, usually determined by the company's board of directors. Several factors influence the dividend policy, including the company's financial position, growth prospects, and capital needs. Some companies pay a flat-rate dividend per share held by the investor, while others distribute a variable dividend based on the company's profits.

Deciding to issue a dividend is an involved process involving multiple important dates that investors should know. The following are the most important steps in the dividend allocation process.

- Declaration date: The board of directors declares a dividend and sets the dividend amount and payment date.

- Record date: The record date is when the company determines which shareholders can receive the dividend. To do this, they create a list of all shareholders who held the stock or fund on the declaration date and issue dividends based on shares held.

- Ex-dividend date: The ex-dividend date is two business days before the record date. Investors who purchase shares on or after the ex-dividend date will not receive the dividend.

- Payment date: The payment date is when the dividend is paid to eligible shareholders. It is usually several weeks after the record date.

It's important to note that the decision to pay dividends is ultimately up to the company's board of directors, and very few companies are required to pay dividends. Research an ETF's dividend distribution history before you buy to be sure that the investment you're choosing pays out a regular dividend.

What Are Capital Gains?

Capital gains are profits that an individual or a business earns from selling a capital asset, such as stocks or real estate. Capital gains occur when the asset's sale price is greater than the original purchase price. For example, if you bought your home for $250,000 and sold it for $300,000 when you moved, you have seen a capital gain of $50,000.

Like other investments, ETFs can generate capital gains when sold for a higher price than you purchased them. These capital gains are subject to taxation by the government and may be taxed at the capital gains rate or your standard income tax rate. As noted above, the distributions you receive from ETFs may qualify for the lower capital gains tax rate depending on the fund's management.

What Does it Mean to Reinvest ETF Dividends?

When an ETF pays a dividend, investors have the option to reinvest the dividend back into the ETF by purchasing additional shares, rather than receiving the dividend as cash. This is known as dividend reinvestment, which can compound your investment returns and dividend income over time.

Many brokerages allow you to enable dividend reinvestments for assets you choose automatically. If you reinvest your ETF dividends automatically, your broker will purchase additional fund shares at the current market rate when the dividend is received.

Note that even if you directly reinvest the dividend after receiving it, the IRS still considers it taxable income in the year it's paid. If you reinvest dividends, you should keep track of their "cost basis" (the original price paid for the shares), as it will affect the amount of capital gains tax owed when you sell the shares.

How to Find ETFs that Pay the Most Dividends

The easiest way to sort ETFs by dividend payout is to use a stock screener. Many financial websites and brokerage platforms offer screening tools allowing investors to filter and sort ETFs based on size and trading volume. Use the screening tool to screen ETFs by "dividend yield," which represents the percentage value of the ETF that investors receive annually in the form of dividends.

Several ETFs can invest in high-dividend stocks. These companies specifically invest their funds in companies that pay out the highest dividends, and actively manage the fund to grow dividends over time. Some examples include the iShares Select Dividend ETF (NYSE: DVY) and the Amplify High-Yield ETF (NYSE: YYY).

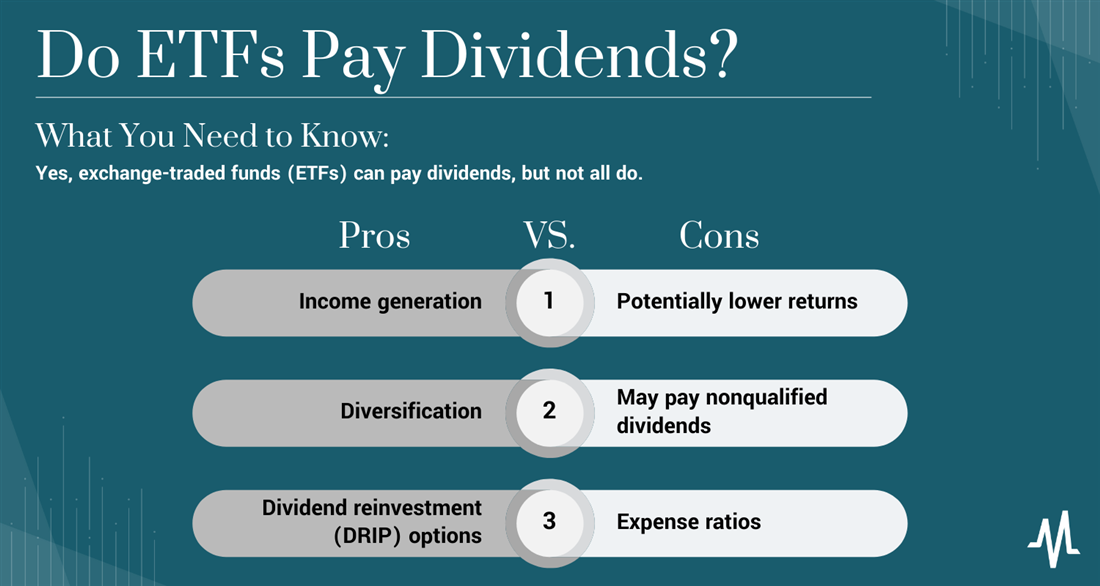

Pros and Cons of Investing in ETFs for Dividends

Before you search for a list of dividend ETFs to start investing in, it's important to weigh the pros and cons of these sometimes-volatile funds.

Pros

First, the potential benefits of investing in ETFs:

- Income generation: ETFs that pay large dividends can provide a steady stream of income for investors, which can be helpful for those looking to supplement their retirement income or meet other financial goals.

- Diversification: ETFs offer investors the ability to invest in a diversified portfolio of stocks with a single investment, which can help to spread risk across multiple companies and sectors and lowers your risk level when compared to investing in individual high-dividend stocks.

- DRIP options: Most ETFs offer direct dividend reinvestment programs, putting your dividend income management on autopilot. This can be useful for busy investors who want to avoid managing their dividends as cash.

Cons

What about the downsides? Take a look:

- Potentially lower returns: ETFs focusing on dividend-paying stocks may provide a different level of capital appreciation than other ETFs focusing on growth stocks. This may reduce your overall return as an investor.

- May pay nonqualified dividends: If you invest in an actively managed ETF that buys and sells stocks throughout the year, your dividends may not qualify for capital gains tax rates. This usually means paying more in taxes on dividends you earn.

- Expense ratios: ETFs include expense ratios that pay for the fund's management. Dividend ETFs may have higher expense ratios than funds that track a major index because management must regularly reevaluate assets included based on dividend payout.

Can You Get Dividends from ETFs?

So — do you get dividends from ETFs? In most cases, the answer is "yes." ETFs may invest in hundreds of underlying stocks, which may pay out a dividend that's passed along to investors. However, like individual stocks, ETFs do not have to pay dividends, and any funds you invest in are free to cut future dividends at any time. Reviewing a fund's dividend payout history can help you choose viable assets for creating a long-term income stream.

FAQs

Still have questions about dividend ETFs? Look at several we've compiled.

Which ETF pays the highest dividend?

Do ETFs pay good dividends?

The dividend yield of an ETF depends on the underlying securities held in the fund. Some ETFs might invest heavily in growth stocks that do not yet have the infrastructure to pay dividends, while others may invest heavily in dividend stocks to attract investors. Check out each ETF's dividend payment history to learn more about the type of distributions you can expect.

How often does an ETF pay dividends?

Some ETFs pay dividends every quarter, while others may pay dividends monthly or annually. You can typically find a dividend schedule for an ETF on the fund's website or through a collective stock and ETF database like MarketBeat.