We'll take a few moments to look at this ETF research tool so that you can understand the significance of ETF screeners and how to employ them effectively. Whether you're an experienced investor seeking the best ETFs or a newcomer eager to explore the world of ETFs, we'll help you learn more about ETF investing and how to take charge of your financial future by discovering the power of informed investing.

What is an ETF Screener?

An ETF screener, also called an ETF scanner, is a user-friendly and potent financial tool designed to assist investors in navigating the vast landscape of exchange-traded funds (ETFs). It functions as a virtual ETF filter, sifting through numerous ETF options available in the market based on specific criteria and parameters the user sets.

This invaluable ETF analyzer simplifies the investment research process, enabling you to identify and compare top ETFs that align with your unique financial goals, risk tolerance and preferences.

Why Use an ETF Screener?

Utilizing a screener in your ETF search endeavors can be a game-changer, regardless of your experience level. This powerful ETF evaluator tool offers many benefits, empowering you to make well-informed decisions and optimize your ETF exposure within your personal investment strategy. Let's take a few minutes to explore why incorporating an ETF Screener into your investment process is essential to a winning investment strategy.

The ETF screener streamlines the research process by efficiently narrowing the vast universe of ETFs to a manageable list that meets your specific criteria. Instead of manually sifting through hundreds of options, you can quickly identify the best ETFs that align with your investment goals and preferences. With an ETF fund screener, you can employ various customizable filters to define your search criteria. By tailoring these filters, you can discover ETFs that precisely match your desired attributes.

Incorporating an ETF screener into your investment process is a strategic investment method. This invaluable ETF finder empowers investors with efficient research, data-driven analysis and a well-rounded understanding of potential investment options. By leveraging the capabilities of this power ETF database screener, you can construct a well-diversified and informed investment portfolio that aligns with your financial objectives and risk tolerance, ultimately paving the way for long-term financial success.

How ETF Screeners Work

ETF screeners are powerful tools designed to simplify finding the most suitable exchange-traded funds (ETFs) for investors. ETF screeners work a lot like stock screeners used to research individual stocks. They utilize advanced algorithms and vast databases to filter and sort through numerous ETFs available in the market based on user-defined criteria. These screeners operate on comprehensive databases that contain detailed information about a wide array of ETFs. When using an ETF screener, you can define your search criteria according to your investment goals, risk tolerance and preferences. This customization empowers investors to narrow their options and focus on the most relevant ETFs. It is important to note that most ETF screener free services are typically delayed by 10 to 20 minutes, allowing time for the databases to update.

ETF screeners offer various customizable filters, such as expense ratios, historical performance, asset class, sector focus, geographic exposure, dividend yield, Sharpe ratio and other performance metrics. Once you set your preferred filters, the ETF screener conducts real-time data analysis on the ETF database, evaluating each fund against the specified criteria. The screener then generates a list of top ETF recommendations that align with the investor's criteria, presenting a concise and relevant selection.

ETF screeners often allow you to save your search criteria and set up alerts for any changes in the recommended ETFs' performance and suitability over time. This ongoing monitoring ensures that investors stay informed about potential shifts in their chosen ETFs' performance and adapt their investment strategy accordingly. An additional advantage of the best ETF screener is its accessibility and cost-free nature, making them widely available to investors regardless of their financial resources. This democratization of access empowers individual investors with the same powerful tools once predominantly available to professionals.

Example of Using an ETF Screener

Let's take a few minutes to look at an example of how to use an ETF screener. In this example, we will show you how to run an ETF stock screener walking you through the process step-by-step. We will adopt a universal approach that can be implemented across various software and web-based packages, encompassing ETF Selector, ETF Explorer, ETF Tracker, ETF Grader, or Dividend ETF Screener tools. This generalized approach will provide a comprehensive methodology to effectively utilize the leverage, features and functionalities of these diverse tools. By employing this versatile approach, you can efficiently navigate the world of ETFs, identify your desired funds, explore in-depth ETF profiles, track performance and evaluate suitability based on individual preferences and investment goals.

For this example ETF screener, let's find an ETF that closely matches the iShares Biotechnology ETF (NASDAQ: IBB). The iShares Biotechnology ETF from Blackrock Investments tracks the biotechnology industry. By leveraging the ETF screener's customizable filters and comprehensive data analysis, we aim to showcase how this invaluable tool empowers investors to identify ETFs with similar characteristics, such as sector focus and risk-adjusted returns.

Step 1: Access the ETF screener.

To begin, visit a reputable financial website, like MarketBeat, that offers a free ETF Screener. Ensure that the platform has access to up-to-date and comprehensive ETF data. Once on the website, locate the ETF Screener tool to initiate the search.

Step 2: Define search criteria.

Step 2: Define search criteria.

We will use the iShares Biotechnology ETF (NASDAQ: IBB) as the target ETF in this example. We want to find ETFs with similar characteristics to IBB, which tracks the performance of the biotechnology sector. You can easily do this with other sectors like the energy sector or the mining sector. We will use the ETF screener's search criteria to adjust our filters to target the results further. In the ETF explorer, modify your filters to find ETFs focusing on sectors, providing a list of funds focusing on sectors versus indexes. We will use the ETF Sharpe Ratio Screener to seek ETFs with a risk-adjusted return.

Set a filter to find ETFs with a Sharpe ratio above a certain threshold to ensure they offer better risk-adjusted returns than the broader market. With the search criteria set, run the ETF screener. The tool will analyze the ETF database and provide a list of ETFs that match the specified criteria. Review the list and take note of the ETFs that stand out.

Step 3: Analyze.

Step 3: Analyze.

What is ETF screener data without proper analysis? Consider utilizing a stock and ETF comparison tool to simultaneously compare the key metrics of multiple funds. Our analysis will focus on the iShares Biotechnology ETF (NASDAQ: IBB) since it is the target ETF for our example.

When considering an ETF like iShares Biotechnology ETF, thoroughly examine its detailed profile to make an informed investment decision. Start by reviewing its historical performance, which entails analyzing how the fund has performed over different periods, such as one year, three years and five years. This evaluation allows you to assess the ETF's track record and how it has weathered various market conditions.

Next, pay close attention to the expense ratio, as it directly impacts the ETF's overall returns. The expense ratio represents the percentage of assets deducted annually to cover operating costs. A lower expense ratio is generally preferable because it allows more of the fund's returns to pass on to investors.

Scrutinize iShares Biotechnology ETF's asset holdings to understand its underlying assets and asset allocation. In the case of iShares Biotechnology ETF, the focus would be on biotechnology-related stocks. Evaluating the holdings enables you to gauge the level of diversification and concentration within the fund, which can influence its risk profile. When you assess the holdings, you consider each stock as an individual. It sometimes helps to assess the top holdings, including reviewing each company's profile information, valuation metrics, earnings transcripts and other key valuation metrics.

Another critical aspect is the iShares Biotechnology ETF's dividend policy, especially if you seek income-generating investments. Some ETFs, like dividend-focused ones, distribute dividends to investors regularly, while others may not have a dividend focus.

Examining iShares Biotechnology ETF's institutional ownership is a crucial aspect of investment research, as it provides valuable insights into the confidence and conviction of large, professional investors. Institutional ownership refers to the percentage of a company's shares held by institutional investors such as mutual funds, pension funds and hedge funds. High institutional ownership can indicate that experienced and sophisticated investors believe in the company's growth prospects and overall financial health.

Carefully examining the detailed profile of the ETF, including its historical performance, expense ratio, holdings, dividend policy and institutional ownership, empowers you to make a well-informed decision. Comparing this information with your investment objectives and risk tolerance will ensure that the ETF aligns with your financial goals and helps you build a portfolio that reflects your unique preferences and risk appetite.

Step 4: Pull the trigger.

While analyzing the ETFs in your list, consider diversification. Assess whether the ETFs that you are investigating complement your existing investment portfolio or if it overlaps with other holdings. Diversification is crucial to manage risk effectively and optimize potential returns.

Based on the information gathered, determine whether iShares Biotechnology ETF aligns with your investment goals and risk appetite. If it meets your criteria and fits nicely into your diversified portfolio, consider including it in your investment strategy. Using an ETF screener is a valuable and user-friendly way to find ETFs that align with specific investment objectives. The ETF screener can match desired sectors, risk-adjusted returns and other criteria. However, conduct thorough research and due diligence before making investment decisions, as ETF performance and suitability can vary over time.

How to Use MarketBeat's ETF Screener

MarketBeat's free ETF screener is a robust tool that empowers investors to navigate the world of ETFs with precision and efficiency. With a user-friendly interface and comprehensive features, this screener offers valuable insights to tailor your ETF search according to your unique investment objectives and risk preferences. Let's review step-by-step instructions on effectively using MarketBeat's ETF Screener to unlock data, analyze ETFs across various criteria and make well-informed investment decisions.

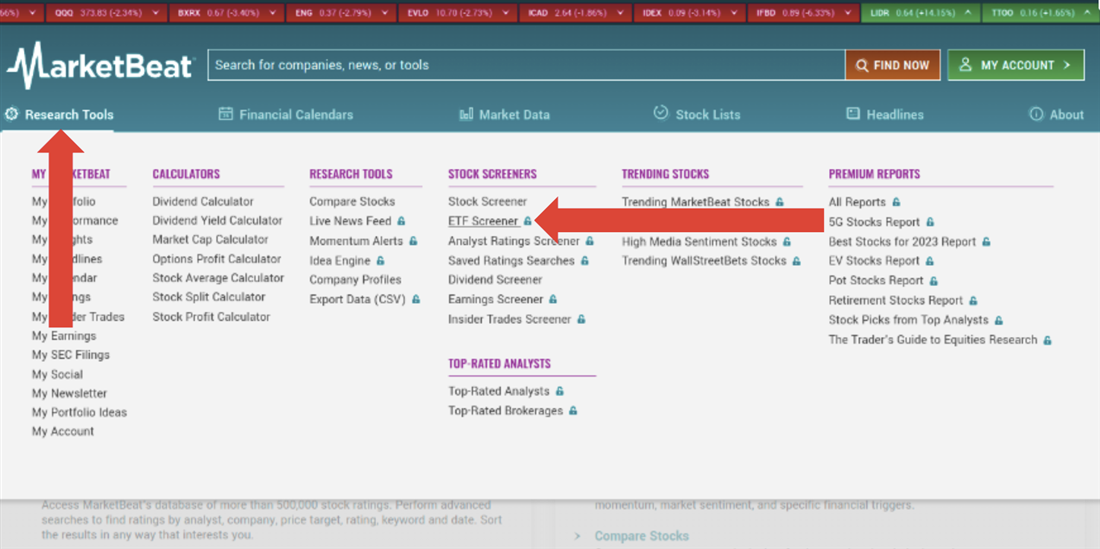

Access the ETF Screener

Begin by navigating to MarketBeat's website. In the "research tools" menu, locate "ETF screener," located in the "stock screeners" section of the menu. You can also find it in the "screeners" section of the MarketBeat All Access Research Tools page.

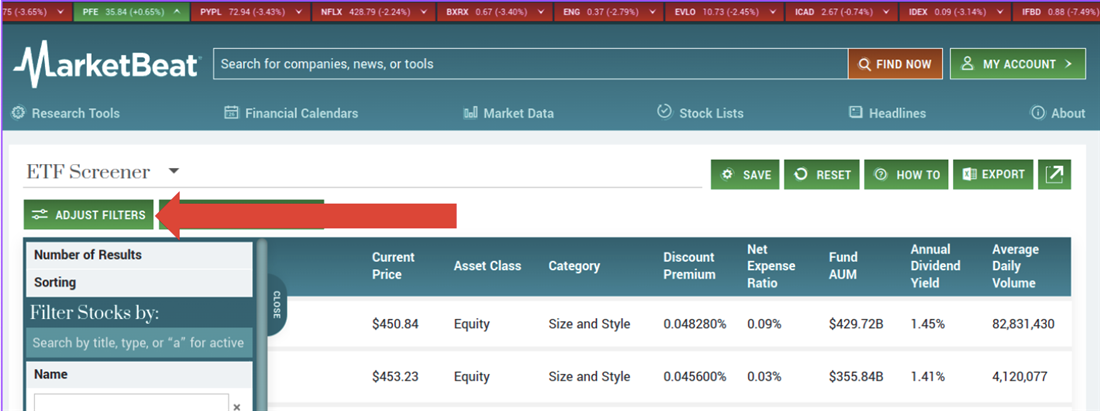

Define Your Search Criteria

Once you have navigated to the screener page, you will notice on the left side top of the page the options for adjusting the filters and customizing the columns of your research setup. Click the "adjust filters" button and start customizing your ETF search by setting specific investment criteria. You can filter ETFs based on asset class, sector focus, expense ratio, dividend yield and performance metrics. MarketBeat's ETF screener offers a range of filters and sorting options to refine your search. Choose filters that align with your investment objectives, such as selecting specific sectors or geographic regions.

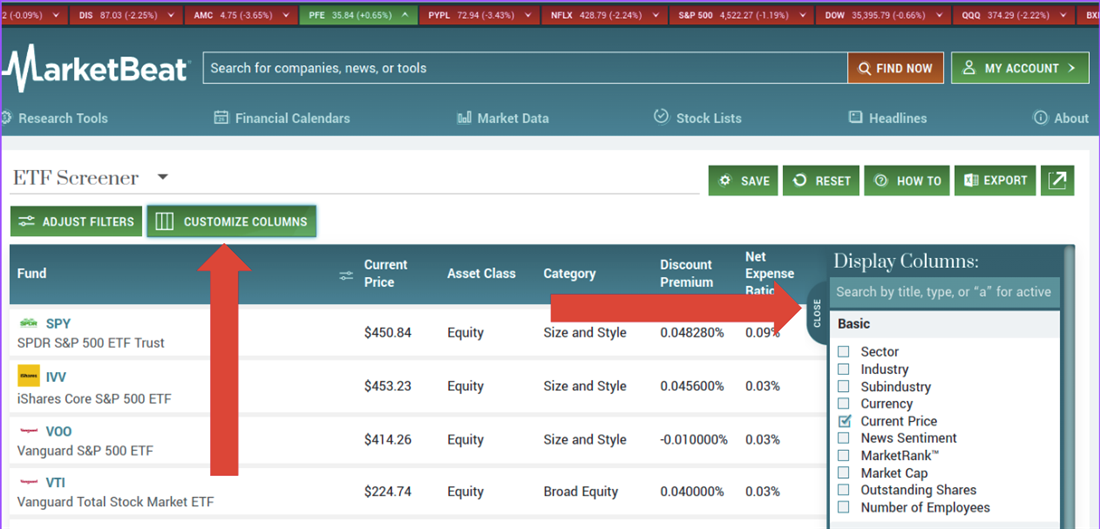

Focus on Key Metrics

Use the "customize columns" button to adjust the view table to provide you with the key metrics you want to analyze. Pay attention to key performance metrics such as net expense ratio, discount premium and volatility. These metrics provide insights into the risk-return profile of ETFs and help you evaluate their performance relative to the market. Once you have set your criteria and filters, the ETF screener will generate a list of ETFs that match your preferences. Review the profiles of the ETFs in the results to gain a deeper understanding of their holdings, expenses and historical performance.

Dive into Additional Data

Dive into Additional Data

Take advantage of additional data and resources provided by MarketBeat. Explore analyst ratings, expert opinions and recent news related to the ETFs you plan to research to gain a comprehensive view of each investment option. As you identify potential ETFs that align with your investment goals, consider saving them to your watchlist for further monitoring. It can help you track their performance and make timely decisions. You can also save and export your ETF screener research list by utilizing the buttons in the upper right area of the screener page.

ETF investing requires continuous research and monitoring. MarketBeat's ETF Screener is a valuable tool to use regularly to stay informed about your chosen ETFs' latest market trends, news and performance.

How to Customize ETF Screening

Customizing ETF screening is a pivotal aspect of using an ETF screener to cater to individual investment preferences and financial objectives. By employing a free ETF screener, you can harness the power of data-driven analysis and tailored filters to identify ETFs that align precisely with their unique requirements. Let's explore different ways to customize ETF screening to optimize investment decisions.

- Income-seeking scenario: For investors seeking regular income from their investments, prioritizing dividend-focused ETFs is key. Customizing the screener involves filtering ETFs with high dividend yields and a consistent history of dividend payments. Adjusting the minimum and maximum dividend yield preferences to match your desired income range is crucial. Additionally, consider focusing on ETFs with a history of dividend growth, as this may signal potential future income increases.

- Growth-seeking scenario: For those with long-term capital appreciation as their objective, emphasizing ETFs with solid growth potential is essential. Customize the screener to prioritize ETFs with high historical returns over various timeframes, such as one-, three- and five-year periods. By increasing the weighting on historical performance, you can emphasize growth-oriented funds. Furthermore, narrowing down the screener results to specific sectors or industries with promising growth prospects can refine your search.

- Risk-averse scenario: For risk-averse investors, stability and capital preservation are paramount. Customizing the screener involves filtering ETFs with low historical volatility and beta values. A lower beta indicates that the ETF tends to be less volatile than the market, which may suit risk-averse investors. Additionally, consider ETFs focusing on defensive sectors like consumer staples, utilities or healthcare, as these tend to be more resilient during market downturns.

- Sector-specific scenario: Investors seeking exposure to specific sectors or industries can use the screener to refine their choices. Customize it to filter ETFs that exclusively target your desired sector or industry. For instance, if you're interested in technology, healthcare, or renewable energy, adjust the screener to display ETFs with relevant sector focuses. Compare these sector-specific ETFs' expense ratios and historical performance to identify the most suitable option.

- Global diversification scenario: To achieve broad global diversification and reduce concentration risk, expand the screener's geographic exposure. Include ETFs from different regions like North America, Europe, Asia and emerging markets. Prioritize ETFs with exposure to diverse countries and holdings across various sectors and industries to enhance diversification benefits further.

- Environmental, social, governance (ESG) investing scenario: If you want to align your investments with environmental and social values and strong governance practices, you can tailor the screener. Customize it to filter ETFs that follow ESG principles and prioritize companies with high ESG scores. Focus on ETFs that promote sustainability, ethical practices and positive social impacts. Consider ETFs that actively engage with companies to foster positive ESG practices.

Regular monitoring and adjustments based on changing market conditions contribute to constructing a well-optimized and diversified investment portfolio.

ETF Screener Tips for Beginners

For beginners venturing into the world of ETF investing, leveraging a free ETF screener can significantly simplify the process and enhance decision-making. By understanding the basics of what an ETF screener is and how to use it, you can make more informed choices and embark on a successful investment journey. Here are some valuable tips for navigating the world of ETF screeners.

Define Investment Goals and Risk Tolerance

Before using an ETF screener, clearly define your investment goals and risk tolerance. Are you seeking long-term growth, regular income or capital preservation? Understanding your objectives helps set the appropriate screening criteria.

Start with Broad Filters

As a beginner, start with broad filters in the ETF screener. Consider asset classes like equities or bonds and explore diversified ETFs that cover various industries and regions. Broad filters offer a good starting point for building a balanced and diversified portfolio.

Keep it Simple

Avoid overwhelming yourself with too many filters or intricate criteria. As a beginner, simplicity is key. Start with a few essential filters and gradually expand your criteria as you become more familiar with the process and ETF investing.

Diversify Your Portfolio

Emphasize the importance of diversification while using an ETF screener. Diversifying across different asset classes, sectors and geographic regions helps mitigate risk and improve the overall stability of your investment portfolio.

Continuously Educate Yourself

ETF investing offers a wealth of opportunities, but it requires continuous learning. Stay informed about market trends, economic conditions and industry developments. Regularly educate yourself to make more informed decisions while using the ETF screener.

Pros and Cons of ETF Screeners

ETF screeners have emerged as invaluable tools, but like any financial tool, ETF screeners come with advantages and limitations. In this section, we'll explore the pros and cons of ETF screeners and shed light on their potential benefits and areas where users should exercise caution. Let's thoroughly examine the merits and drawbacks of using ETF Screeners for more informed investment decisions.

Pros of ETF Screeners

ETF screeners have revolutionized how investors approach the world of exchange-traded funds (ETFs), offering an arsenal of benefits that simplify the investment research process. These powerful tools have become indispensable companions for novice and seasoned investors, providing a data-driven approach to identifying ETFs that align with individual preferences and investment goals. Let's explore the advantages of using free ETF screeners.

- Efficient research: ETF screeners streamline the research process, saving investors time and effort by swiftly narrowing down ETF options based on specified criteria. This efficiency helps investors focus on the most relevant funds without being overwhelmed by many choices.

- Customization: ETF screeners offer a high level of customization, allowing users to define their search parameters based on individual investment goals, risk tolerance and sector preferences. This tailored approach ensures that the ETFs suggested by the screener align closely with the user's specific requirements.

- Data-driven analysis: ETF screeners provide objective data and analysis on various ETFs, including historical performance, expense ratios, holdings and risk metrics like the Sharpe ratio. This data-driven approach enables users to make well-informed investment decisions supported by thorough research.

- Diversification assistance: You can identify ETFs that offer exposure to different asset classes, sectors and geographic regions, promoting diversification within their portfolios and reducing the risk associated with individual securities.

- Accessibility: Many ETF Screeners are free, making them accessible to many investors regardless of their financial means. This democratization of access allows investors to benefit from powerful research and analysis capabilities without additional costs.

Cons of ETF Screeners

While ETF Screeners undeniably offer many advantages, like any financial tool, they have limitations. As investors increasingly rely on these sophisticated screening tools to narrow their ETF choices, it becomes crucial to understand the potential drawbacks of their usage. Let's dive into an insightful examination of the cons associated with ETF screeners, equipping investors with the knowledge they need to navigate the complexities of the investment landscape with discernment.

- Risk of over-reliance: While ETF screeners offer valuable insights, there is a risk of over-relying on the tool's recommendations without conducting additional research. Perform due diligence and fully understand the ETF's characteristics and underlying holdings.

- Data accuracy and timeliness: ETF screeners rely on the accuracy and timeliness of the data they access. Outdated or erroneous information may lead to suboptimal investment decisions, highlighting the importance of using reputable sources and conducting periodic data verification.

- Narrow focus: Customization can be a double-edged sword. While it allows users to focus on specific criteria, it may also lead to a narrow view, overlooking potentially attractive investment opportunities that do not fit the preset filters.

- Limited human element: ETF screeners rely on algorithms and data analysis, lacking the human judgment experienced financial professionals can provide. While screeners offer efficiency, investors should remember that human insight can be valuable in complex market conditions.

- Market volatility challenges: ETF screeners may face challenges during periods of market volatility, as historical data may not accurately predict future performance. Investors should remain cautious and consider the impact of rapidly changing market conditions.

Screening for Success

ETF screeners offer a powerful toolkit for investors to navigate the vast world of ETFs efficiently and precisely. By harnessing these free tools and leveraging the ETF Sharpe ratio screener, investors can make well-informed decisions tailored to their investment goals and risk preferences. However, strike a balance and avoid over-reliance on screeners, complementing their insights with thorough research. Embrace continuous learning and stay vigilant during market fluctuations to empower investors to succeed. ETF screeners are valuable companions to embark on growth, diversification and financial prosperity.

FAQs

This section addresses the most frequently asked questions (FAQs) about ETF screeners and provides comprehensive answers to empower you with the knowledge to make informed decisions.

What is an ETF screener?

An ETF screener is a powerful online tool that allows investors to filter through various ETFs based on specific criteria. It enables users to customize their search based on investment goals, risk tolerance, sector preferences, expense ratios, historical performance and other factors. Using an ETF screener, you can efficiently narrow your choices and identify ETFs that closely align with your unique preferences and objectives.

How do you use an ETF screener?

Using an ETF screener involves defining your investment criteria and setting filters accordingly. Start by selecting the ETF screener of your choice and enter your preferences, such as asset class, sector focus, geographic exposure or expense ratio thresholds. The screener will then generate a list of ETFs matching your criteria, allowing you to review and compare their profiles in depth. This data-driven approach empowers investors to make well-informed decisions and build a diversified portfolio tailored to their needs.

How do I find good ETFs to invest in?

Finding suitable ETFs to invest in can be facilitated by utilizing an ETF screener. Start by determining your investment objectives and risk tolerance. Next, set filters in the ETF screener based on your preferences, such as sectors or asset classes you want to target. Consider factors like expense ratios, historical performance and risk metrics. By narrowing down your choices using an ETF screener, you can identify ETFs that match your criteria and conduct further research to ensure they align with your investment goals.