While there are numerous investment strategies, one approach that has stood the test of time is dividend investing. Dividends, or regular payments made by companies to their shareholders, offer a consistent income stream and are particularly appealing if you seek long-term steady cash flow.

However, with thousands of publicly traded companies and a vast array of investment options, finding the right dividend-paying stocks can take time and effort, which is where a dividend screener comes into play.

We will explore how using a dividend stock finder can be a game-changer if you want to develop a robust dividend portfolio.

What is a Dividend Screener?

A dividend screener is a powerful financial tool designed to assist you in screening and identifying dividend-paying stocks from a vast pool of publicly traded companies. Think of it as a specialized filter that helps you sift through the stock market's noise to find those hidden gems that align with your dividend investing goals.

A dividend analyzer operates based on specific criteria and metrics that you set. These criteria can include factors like dividend yield, dividend history, payout ratio, market capitalization, etc. By applying these filters, the screener narrows down the list of potential dividend stocks, presenting you with a curated selection of companies that meet your desired dividend-related parameters.

If you seek dividends, one of the most crucial metrics is the stock screener dividend yield. The dividend yield is calculated by dividing the annual dividend per share by the stock's current market price. A high dividend yield indicates that a company returns a significant percentage of its stock price in the form of dividends. Understanding a company's dividend history is vital in assessing its consistency in paying dividends. A dividend history tool within a dividend screener allows you to review a company's past dividend payments, indicating whether it has a track record of reliable dividends.

For some investors, high dividend-paying stocks are particularly appealing. A high dividend stock screener helps identify companies with above-average dividend yields, catering to these preferences. In addition, a dividend comparison tool is useful if you are seeking to compare dividend-related metrics between different companies. You can make informed decisions by analyzing dividend stocks side by side.

Using a dividend screener offers several advantages. First and foremost, it saves a tremendous amount of time and effort. Instead of manually sifting through countless stocks, the screener streamlines the process, allowing you to focus solely on dividend-paying stocks that match your preferences. The screener also promotes focused research, preventing you from becoming overwhelmed with irrelevant stocks. You can concentrate on the most relevant investment opportunities by narrowing down the options based on specific criteria.

Moreover, a dividend screener enhances decision-making objectivity. Relying on data-driven analysis, it reduces emotional biases that might influence investment decisions, leading to more informed choices. When selecting the best dividend stock screener, you should consider factors such as ease of use, accuracy of data, depth of analysis and alignment with your investment strategy.

A dividend screener is an indispensable tool for dividend investors, simplifying the process of finding promising dividend-paying stocks. Leveraging its features and functionalities can significantly enhance your ability to build a stable, income-generating portfolio. In the following sections, we will explore different dividend screening techniques and the best stock dividend screener available to help you optimize your dividend investment journey.

Why Use a Dividend Screener?

Navigating the vast sea of investment opportunities in the stock market can be daunting, especially for those seeking dividend-paying stocks. A dividend screener serves as a sophisticated filter, streamlining the process of finding dividend-paying stocks among many publicly traded companies.

By setting specific criteria, such as dividend yield, dividend history and payout ratio, the screener narrows the list to a carefully curated selection of potential dividend investments that align with your preferences.

For income-focused investors, dividend yield is a critical metric. A dividend screener becomes a treasure trove for those seeking high dividend yield stocks, allowing them to target companies that offer attractive returns in the form of dividends. Informed decision-making in the world of investments relies on comprehensive data analysis. With a dividend screener, you can access essential dividend metrics like a company's dividend history, payout ratios and dividend growth rates. These insights clearly show a company's past dividend performance, financial stability and commitment to rewarding shareholders.

The beauty of a dividend screener lies in its ability to cater to individual investment strategies. By customizing the screener's parameters, you can align your investment approach with your unique financial goals and risk tolerance. Whether you prefer stable dividend-paying blue-chip stocks or high-growth dividend stocks, the screener empowers you to fine-tune your search.

Diversification is a key principle for managing risk and optimizing returns in an investment portfolio. A dividend stocks screener helps you identify dividend stocks across various industries and sectors, promoting diversification within your holdings. This diversification strategy reduces exposure to industry-specific risks and enhances the overall stability of your portfolio.

Emotional biases can cloud investment decisions, leading to suboptimal outcomes. A dividend screener is rooted in data-driven analysis, enabling you to make objective and rational choices. By reducing the influence of emotions, the screener ensures that your investment decisions are grounded in concrete financial data. Cost-effectiveness is an essential consideration for you, as it is with any investor. Fortunately, many dividend screeners are available for free or relatively cheap, making them a cost-effective tool.

By utilizing free dividend screeners, you can access valuable financial data without incurring significant expenses, aligning with a financially prudent approach to investing.

A dividend screener is an invaluable ally to generate a steady income stream. Its efficiency, focus on high dividend yield stocks, access to essential metrics, and flexibility in investment strategies make it an essential tool. By embracing the dividend screener, you can unlock the potential of dividend investing and embark on a rewarding financial growth and stability journey.

Let's explore various dividend screening techniques, equipping you with practical insights on effectively using a dividend screener to identify the best dividend-paying stocks in the market.

How Dividend Screeners Work

Dividend screeners are ingenious tools designed to simplify identifying lucrative dividend-paying stocks from the vast universe of publicly traded companies. By employing specific criteria and financial metrics, these screeners efficiently filter through the market noise, presenting you with a tailored selection of dividend stocks that align with their investment objectives.

At the core of how dividend screeners work is a data-driven approach. These tools gather relevant financial data from various sources, including financial databases and stock exchanges, to create a comprehensive database of publicly traded companies. Once the data is collected, you can set their criteria based on factors like dividend yield, dividend history, payout ratio, market capitalization and sector preferences.

The dividend screener then applies these filters to the database, systematically eliminating companies that do not meet the specified criteria. For example, if you set a minimum dividend yield of 4%, the screener will exclude all stocks with dividend yields below this threshold. Similarly, if you require a consistent dividend history of at least five years, the screener will eliminate companies that do not meet this criterion. As the screener narrows down the list, it presents you with a curated selection of dividend stocks that match their preferences. This targeted list includes relevant dividend metrics for each stock, such as dividend yield, dividend growth rates and dividend history, providing you with essential insights into a company's dividend-paying track record and financial stability.

One of the significant advantages of dividend screeners is their ability to be customized and fine-tuned to suit individual investors' preferences. You can adjust their criteria based on changing market conditions, risk appetite, or financial goals. For instance, you may prioritize dividend stocks with lower volatility and higher dividend yields during economic uncertainty. Moreover, dividend screeners often offer real-time or periodic updates to reflect changes in company financials and market conditions. This feature ensures that you have access to the latest information when making investment decisions, allowing them to stay informed about their dividend stocks' performance.

Another crucial aspect of dividend screeners is their cost-effectiveness. Many screeners are free or reasonably priced, making them accessible to everyday investors. These cost-effective options enable you to access valuable financial data without incurring substantial expenses. Dividend screeners are invaluable tools that leverage data and specific criteria to streamline the process of identifying promising dividend-paying stocks. By employing a data-driven approach, offering customization options and providing real-time updates, these screeners empower you to build well-informed and diversified dividend portfolios.

Example of Using a Dividend Screener

This comprehensive example will walk you through effectively utilizing a dividend screener to search for dividend-paying stocks. By employing a dividend screener, you can access critical dividend metrics and make well-informed investment decisions that align with your income objectives.

For this example, we will assume that you already own shares of Morgan Stanley (NYSE: MS), a powerhouse in the financial services industry. Morgan Stanley has been a strong performer, and its consistent dividend payments have added a steady income stream to your portfolio. But now, you're hungry for more and want to discover other dividend-paying stocks that share the same allure as Morgan Stanley. Let's uncover other dividend-paying stocks that mirror the appeal of Morgan Stanley.

This is where a dividend screener comes into play, a versatile tool that will help you sift through the vast sea of stocks to find those with similar dividend attributes.

- Step 1: Embrace a suitable dividend screener. The first order of business is to choose the perfect dividend screener. Opt for one that's user-friendly, comprehensive and offers a range of screening options. A good dividend screener will make your quest for dividend-paying gems seamless and enjoyable.

- Step 2: Bring Morgan Stanley to the spotlight. As you've already invested in Morgan Stanley, input its key financial data into the dividend screener. Record the dividend yield, annualized three-year dividend growth rate and payout ratio. These metrics will act as your benchmark.

- Step 3: Define your desired criteria. Set your criteria based on Morgan Stanley's attributes. Seek out dividend-paying stocks with metrics similar to Morgan Stanley's dividend yields, growth rates and payout ratios. This way, you can unearth potential investments that align with your investment goals.

- Step 4: Let the screening begin. Run the dividend screener with your defined criteria. Sit back and watch as the screener does its magic, generating a list of dividend-paying stocks that match Morgan Stanley's financial allure.

- Step 5: Delve deeper with research. Explore the list of potential dividend-paying stocks the screener churns out. Gather crucial financial and business information for each company, paying attention to market capitalization, industry and recent performance.

- Step 6: Assess the sustainability of dividends. Go beyond the initial metrics and scrutinize the sustainability of each company's dividends. Consider revenue stability, earnings growth prospects and debt levels, which ensure that dividends remain consistent and reliable.

- Step 7: Diversify your portfolio. As you identify stocks similar to Morgan Stanley, focus on building a diversified portfolio. Aim to include stocks from different industries and sectors to spread risk and maximize returns.

With the potent tool of dividend screeners, you can embark on a rewarding journey to find dividend-paying stocks. Embrace the thrill of discovering new investment opportunities that complement your dividend-focused strategy. Remember to conduct thorough research, evaluate dividend sustainability and maintain a diversified approach for the ultimate success in your dividend investing endeavors.

How to Use MarketBeat's Dividend Screener

MarketBeat's dividend screener is a robust tool for identifying promising dividend stocks that align perfectly with your investment goals. Let's explore how to navigate this user-friendly platform step-by-step, learning how to uncover dividend gems for your portfolio.

Access MarketBeat's Dividend Screener

To begin your dividend stock discovery journey, visit the MarketBeat website and access the dividend screener. You can find it under the "screener" section or by searching for "MarketBeat dividend screener" in your preferred search engine.

Define Your Investment Parameters

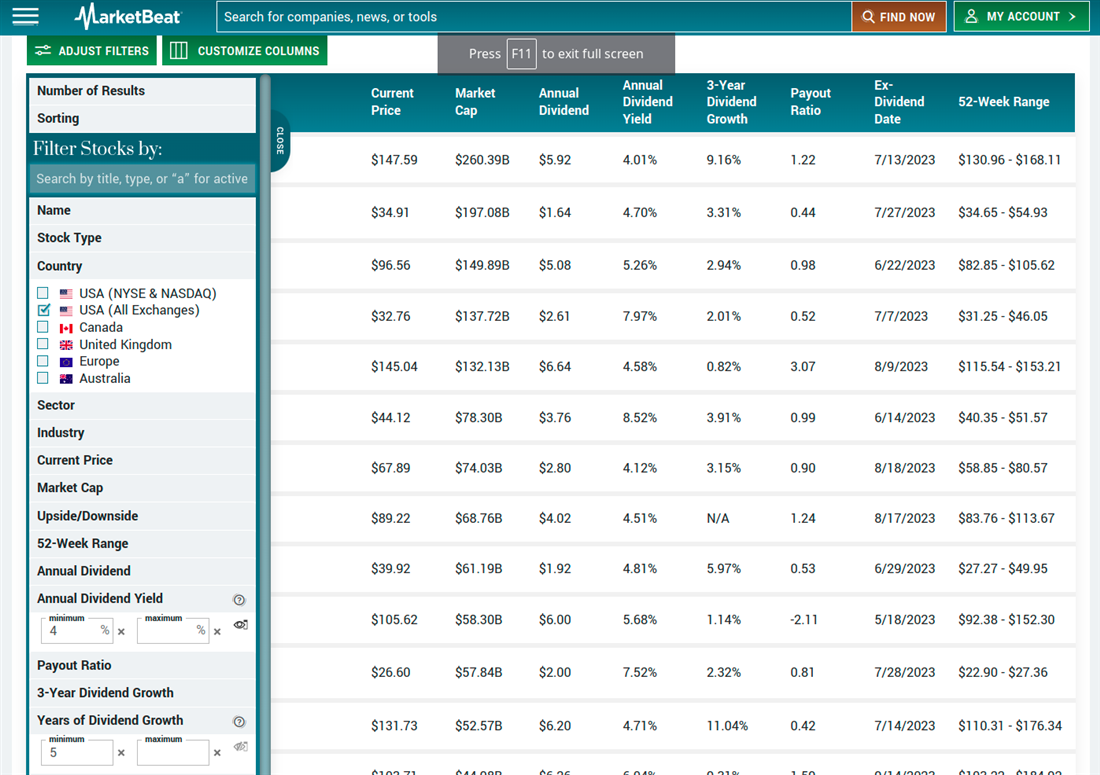

In the upper left-hand of the dividend screener page, you will find the "adjust filters" button. Clicking this allows you to adjust the filters of the screener. Now, define your specific investment parameters based on your financial objectives.

For example, if you seek high-yield dividend stocks, set a filter for dividend yield above a certain percentage (e.g., 4% or higher). If you prefer dividend-achieving companies with a history of consistent dividend growth, consider setting a minimum number of consecutive years of dividend increases. Using the search bar to search "A" will show you all of the filters you have currently got selected.

Evaluate Dividend Safety and Sustainability

Incorporate criteria that assess the safety and sustainability of dividends. Look for stocks with a reasonable dividend payout ratio, indicating that the company retains significant earnings for future growth. Consider filtering for stable revenue and earnings growth stocks, healthy cash flow and manageable debt levels.

View and Analyze Results

After setting your criteria, run the dividend screener to generate a list of dividend-paying stocks that meet your preferences. Analyze the results, paying attention to key financial metrics, dividend history, and company fundamentals. Analyzing your dividend stocks lets you narrow your choices and focus on the most promising ones.

MarketBeat's dividend screener enables you to efficiently discover dividend stocks that align perfectly with your investment objectives. By customizing your search criteria, evaluating dividend safety and utilizing the dividend screener free option, you'll unlock the power of dividend stock discovery.

How to Customize Dividend Screening

If you seek reliable income and growth potential, dividend screening is a powerful tool to help you identify the perfect dividend stocks to complement your investment strategy. However, the world of dividend investing is vast and diverse and different people have distinct preferences and objectives. Let's explore how to customize dividend screening for various popular dividend strategies, empowering you to fine-tune your approach and find the ideal dividend stocks that align with your unique financial goals.

- Dividend capture strategy: The dividend capture strategy requires precise timing to capture dividends efficiently. To customize your dividend screener for this strategy, focus on short-term criteria. Set your screener to filter stocks with upcoming ex-dividend dates. Additionally, consider criteria highlighting liquidity, as you'll want to enter quickly and exit positions to capture dividends. Be sure to stay on top of dividend-related announcements.

- Dividend growth investing: For dividend growth investing, prioritize companies with a strong history of consistently increasing dividend yields. Customize your dividend screener to filter stocks with a minimum number of consecutive years of dividend growth (e.g., 10 years or more). Look for companies with stable revenue and earnings growth, as they are more likely to sustain their dividend growth over time. Consider setting criteria for a reasonable dividend payout ratio, indicating that the company retains enough earnings for future growth.

- High dividend yield strategy: The high dividend yield strategy revolves around seeking stocks with attractive dividend yields. Customize your dividend screener to filter stocks with high dividend yields compared to their industry peers. However, exercise caution, as excessively high yields might signal financial instability. Set additional criteria for financial health indicators, such as dividend coverage ratio and debt levels, to ensure the sustainability of high yields.

- Dividend Aristocrats strategy: To identify Dividend Aristocrats, companies with a long history of increasing dividends, customize your screener to filter stocks that meet specific consecutive years of dividend growth (e.g., 25 years or more). Look for companies from different sectors, providing diversification while maintaining a consistent dividend-growth approach. Additionally, consider setting criteria for minimum market capitalization to focus on stable and established companies.

- Total return strategy: To implement the total return strategy, you'll need to customize your screener to focus on dividend yield and capital appreciation potential. Set criteria for stocks with a combination of attractive dividend yields and strong earnings growth prospects. Look for companies with a history of dividend growth and positive analyst ratings.

- Dividend safety strategy: For the dividend safety strategy, customize your screener to prioritize companies with a solid ability to maintain dividend payments even during economic downturns. Set criteria for stable cash flow, low debt levels and high dividend coverage ratios. Look for companies from defensive sectors that are resilient during economic challenges.

Customizing your dividend screener empowers you to streamline your search for dividend stocks that perfectly align with your investment preferences and financial objectives. Whether you prioritize capturing short-term dividends or seeking long-term growth, your customized dividend screener will be valuable in building a well-rounded and rewarding dividend portfolio. Remember to stay informed about changes in the market and company fundamentals to adapt your screener criteria as needed for optimal dividend investing success.

Dividend Screener Tips for Beginners

Finding the perfect dividend stocks might seem daunting as a beginner. With the proper guidance and tools, you can navigate the realm of dividend screeners and discover promising dividend stocks that align with your financial goals. Before you dive into using a dividend screener, it's essential to establish clear investment goals. Determine whether you seek a steady income stream, long-term dividend growth, or a mix of both. Your goals will guide the criteria you set in the screener, ensuring you find dividend stocks that perfectly match your preferences.

When setting up your dividend screener, begin with basic criteria. Focus on dividend yield, dividend growth and payout ratio. These metrics provide valuable insights into a company's dividend-paying capabilities and sustainability. While high dividend yields might seem enticing, exercise caution. Avoid chasing excessively high yields without conducting thorough research. Companies with high yields may face financial instability, putting their dividends at risk. Balance your criteria to ensure you consider both yield and dividend safety.

For long-term dividend success, prioritize companies with a history of consistent dividend growth. Utilize your dividend screener to identify stocks with a track record of increasing dividends for several consecutive years. Dividend growth indicates a company's commitment to rewarding shareholders over time.

Beyond dividend metrics, delve into a company's financial health. Use your dividend screener to set criteria for stable cash flow, low debt levels and positive earnings growth. A financially robust company will likely sustain its dividend payments during economic challenges.

The dividend payout ratio reflects the proportion of a company's earnings distributed as dividends. A high payout ratio may suggest limited room for future dividend growth. Strike a balance by choosing companies with a reasonable payout ratio, allowing them to reinvest earnings for potential growth.

Diversification is critical to reducing risk in your dividend portfolio. Use your dividend screener to identify dividend-paying stocks from various industries and sectors. A well-diversified portfolio guards against potential downturns in specific sectors and provides a stable income stream.

Using a dividend screener might feel like navigating uncharted waters as a beginner. However, armed with these valuable tips, you can confidently search for promising dividend stocks that align with your investment objectives. Remember to stay patient, conduct thorough research and fine-tune your screener criteria as you gain experience.

Pros and Cons of Dividend Screeners

As you start investing in dividend-paying stocks, it's essential to consider the advantages and limitations of using dividend screeners. These powerful tools can significantly aid you in identifying promising stock screener dividend stocks, but they also come with certain caveats.

Pros of Dividend Screeners

The pros may include:

- Efficiency in identifying dividend stocks: Dividend screeners streamline the process of sifting through thousands of stocks to find those that meet your specific dividend criteria. With a few clicks, you can generate a curated list of dividend-paying stocks tailored to your investment goals.

- Time-saving: Manually analyzing individual stocks can be time-consuming. Dividend screeners, on the other hand, rapidly compile data, presenting you with a comprehensive overview of potential dividend stocks in seconds.

- Customizable criteria: Using a stock screener for dividends or a dividend yield scanner will allow you to customize your search criteria based on your preferred metrics. This flexibility lets you refine your selection and discover stocks that align with your unique dividend investment strategy.

- Access to comprehensive data: Leading dividend screeners provide access to extensive financial data, company fundamentals, historical dividend performance and relevant industry comparisons. Armed with this information, you can make well-informed investment decisions.

- Diversification made easier: Finding dividend stocks from various sectors and industries is crucial for portfolio diversification. Dividend screeners assist you in identifying diverse dividend-paying stocks, spreading risk across your investments.

Cons of Dividend Screeners

The downsides can include:

- Limited human insight: While dividend screeners efficiently process data, they lack the qualitative human touch. They may not consider external factors or future prospects impacting a company's dividend sustainability.

- Reliance on historical data: Dividend screeners primarily rely on historical financial data. Market conditions and business dynamics can change rapidly, affecting a company's future dividend performance.

- Potential complexity: Some dividend screeners may have a steep learning curve, particularly for beginners. Familiarizing yourself with the screener's features and data interpretation may require patience and practice.

- Risk of overlooking hidden gems: Relying solely on screeners might lead you to overlook hidden gems or undervalued stocks that do not fit your initial criteria but have strong potential for dividends.

- No substitute for research: While dividend screeners are powerful tools, you should complement them with thorough research and due diligence. Investing solely based on screener results without understanding a company's fundamentals can be risky.

Use the Power of Dividend Screeners

In the vast landscape of dividend investing, dividend screeners are invaluable tools that empower you to uncover promising dividend stocks. Dividend screeners offer a range of benefits, including efficiency, time-saving capabilities and customization options. By defining your investment goals, choosing a user-friendly screener and setting relevant criteria, you can fine-tune your search for dividend gems that align perfectly with your financial aspirations.

FAQs

As you dig into dividend screeners, it's natural to have questions. Let's address some of the most common queries to help you gain clarity and confidence in your dividend screening journey.

What is the best dividend finder?

MarketBeat's dividend screener shines as one of the top screeners for the best dividend stocks. MarketBeat's dividend screener offers a powerful and user-friendly platform to identify dividend-paying stocks based on your specific criteria. MarketBeat provides a comprehensive and up-to-date dividend screening experience with a vast database and frequent updates. Utilize this efficient tool to discover dividend gems that align perfectly with your investment goals.

How do you screen stocks for dividends?

Screening stocks for dividends involves using specialized tools called dividend screeners. These screeners allow you to filter stocks based on dividend-related metrics such as dividend yield, dividend growth, payout ratio and dividend history. You can customize your screening criteria to match your preferred investment strategy. By setting relevant parameters in the screener, you can efficiently narrow down the vast stock universe and identify dividend-paying stocks that meet your specific requirements.

What website can I check dividends?

Numerous websites offer dividend-related information. These websites provide access to dividend data, historical dividend performance and dividend news. MarketBeat's dividend screener stands out as a comprehensive resource that allows you to check and analyze the dividends of various stocks quickly and efficiently.